Who’s the best payment processor of 2024?

Payment processing is an important part of running your business — finding the best fit can be frustrating and time-consuming. So, to help you easily find the best fit for your business, we’ve put together a side-by-side comparison chart.

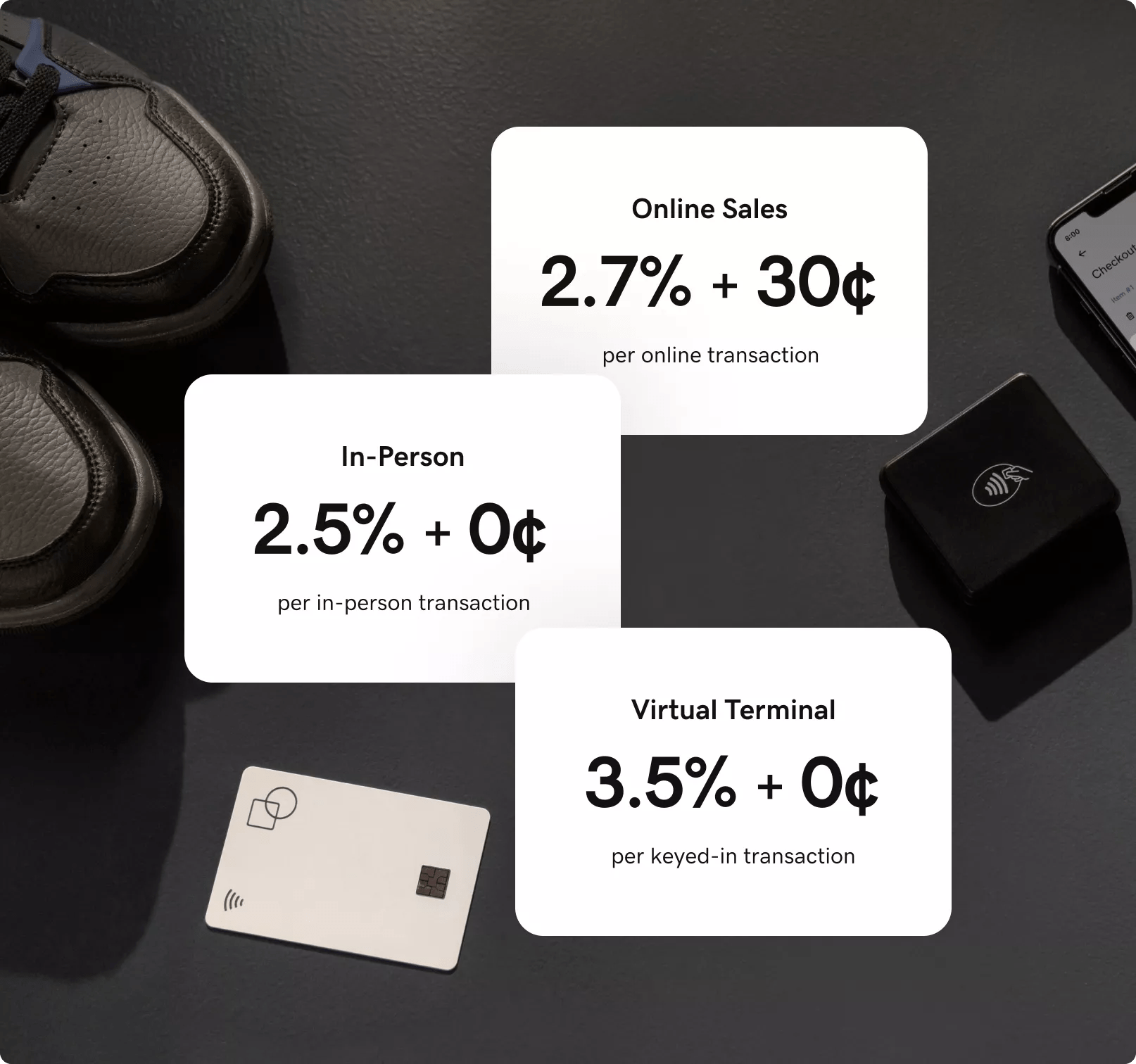

In-person rates

2.3%^ to 2.5% + 0¢

Online Store rates

2.7% + 30¢

Keyed-in rates

3.5% + 0¢

POS (Point of Sale)

Virtual terminal

Shareable payment links

Payment methods accepted - major credit and debit cards and contactless

24/7 live phone support

Ecommerce/online store available

PCI-compliant

In-house marketing services

Our team thoroughly researched available plans from the top payment processors — and spoke with support agents — to provide accurate information for this comparison chart. If you notice any issues with the information, please let us know. Information collected on 03/24/2024.

How to choose the best online payment processing service.

Match your unique business with the right payment processor. Does your business sell services or products? Online, in person, or both? Do you want a credit card terminal or a smartphone to accept payments? Compare payment processor companies to find your best fit.

Why GoDaddy Payments?

GoDaddy Payments enables you to accept payments quickly and securely from all major credit and debit cards, Apple Pay and Google Pay — in person, online and over the phone. And you get paid as fast as the next business day. With GoDaddy Payments, all orders and payments are conveniently managed from a single dashboard, making it easy for you to sell anywhere.

No credit card required.¹