If you own a small business, sooner or later you’ll need to prepare a cash flow statement. A key component of basic financial management, this report lists your monetary resources and obligations, detailing the movement of money in and out of your business.

A cash flow statement that shows positive growth can be used to attract new investors and shareholders.

We know how stressful running your own business can be, especially when you’re just starting out. We also understand that employing an accountant is not always an affordable option.

Not to worry, though — this quick guide has all you need to prepare your own cash flow statement, including free cash flow statement templates.

The ABCs of cash flow statements

To save you time, money and stress, we’ve created this concise guide that answers the questions:

- What is a cash flow statement?

- Why do I need a cash flow statement?

- What should I include in a cash flow statement?

- How do I prepare my first cash flow statement?

We’ve even included a few templates you can download to get started quickly.

1. What is a cash flow statement?

A cash flow statement (sometimes referred to as a statement of cash flows) is simply a document that shows the movement of cash in and out of your business.

Along with a balance sheet and invoice statement, this statement provides a comprehensive look at how your business has made and spent money during a specific time period.

Together, these three documents are essential components in the financial management of any business — even the smallest ones. Cash flow statements, in particular, provide context for the information in your invoice statements and balance sheets, showing clearly how money was outlaid and earned.

Related: Small business accounting tips to help you save money

2. Why do I need a cash flow statement?

Keeping an eye on your income and outlays is an effective way to quickly see how your business is doing financially. For example, a small business that consistently spends more money than it makes is clearly in trouble.

Creating a report on the flow of money not only determines the short-term viability of your business, it also helps you to identify financial cycles and trends.

You can use this report to update your business plan, prepare for seasonal rushes and forecast periods of higher-than-usual expenditures or windfalls.

Having this information gives you greater financial control and more opportunities to grow and expand your business, whatever that might mean for you.

3. What should I include in a cash flow statement?

According to the IFRS Foundation, which sets and maintains the global accounting standards, a statement of cash flows should show how an entity’s cash and cash equivalents have changed over a particular period.

“Cash comprises cash on hand and demand deposits. Cash equivalents are short-term, highly liquid investments that are readily convertible to known amounts of cash and that are subject to an insignificant risk of changes in value.”

Key sections

Cash flow statements are divided into three major sections, which outline different types of financial activities:

Operating activities: This is the money spent on the products and/or services offered by your business (i.e. cash related to production, sale and delivery).

Investing activities: Here you list any cash gained or lost as a result of purchasing or selling an asset including money spent or made from loans.

Financing activities: This section describes the flow of cash between investors (e.g. banks and shareholders) and your business — in other words, money lost or gained from dividends and shares.

It is essential to record both recurring and one-off incomings and outgoings, so that you can get a complete picture of how (and when) money moves through your business.

Depending on local financial regulations, you may also need to disclose any non-cash activities in your statement as a footnote. Examples of non-cash activities include transforming debt to equity, issuing shares and the exchange of non-cash assets.

4. How do I prepare my first cash flow statement?

Before you start pasting numbers into a template, you’ll need to decide the time period you want to report on. You may choose to show cash flow over a month, quarter, half-year or a full financial year.

Next you will need to gather data for each of the three sections listed above: operating activities, investing activities and financing activities.

Two ways to go with operational activities

There are two methods used to present operational activities: direct and indirect.

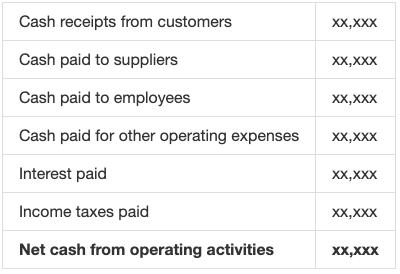

In the direct method cash flows resulting from gross revenue (i.e. total income before deductions) and expenditures are recorded in a basic list of transactions. Although this method is simpler, it is rarely used because the resulting data is not as comprehensive or useful.

Source: IASPlus

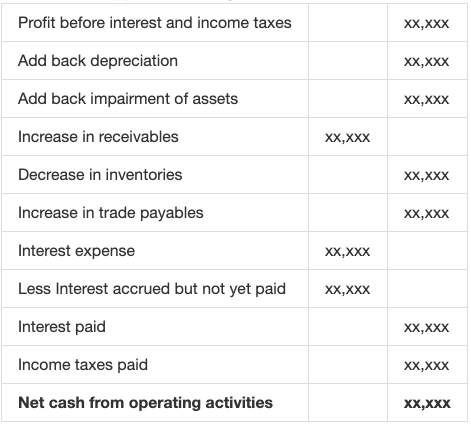

The indirect method starts with the net profit or loss (your total income after operating expenses, interest, taxes and preferred stock dividends have been subtracted) and then makes adjustments to account for the impact of non-cash transactions.

Source: IASPlus

The indirect method is typically only applied to operating activities, which includes everything required to make, sell, market and distribute the business’ product or service. Investing and financing activities are presented as a simple list of incoming and outgoing cash, similar to the direct method.

Free cash flow statement templates

The easiest way to record all this financial data is in a spreadsheet. Fortunately, there are plenty of great templates you can download for free. Here are a few to get you started:

- Microsoft cash flow statement template, a direct method template

- Accounting Simplified statement of cash flows, an indirect method template

- ExcelFunctions cash flow statement template, including Excel functions for easy calculating

All you need to do is fill in your numbers and make the calculations indicated.

A final word on cash flow statements

In this article we have covered what cash flow is, why your business needs to watch it, what data to include and how to prepare your first statement.

Remember, preparing a cash flow statement is a key part of good financial management and will help you:

- Analyse business performance over a period of time

- Evaluate the short-term viability of your business

- Forecast cash flow revenues and expenditures for better planning

- Understand the relationship between income and profit

- Gain greater control over your finances

The biggest benefit is the insight this exercise will provide. You’ll not only be able to plan ahead for recurring high and low tides, but know when to spend money on research and development or opening a second location.

Knowledge is power.