Registering a business in Australia is fairly easy, but as you make your way down the list of requirements, the Goods and Service Tax (GST) question pops up.

Should you register for GST or not? Do you need to? What happens if you need to and don’t?

Every small business needs to register for the GST once it reaches an income threshold. The products or services you offer will also determine whether or not you must charge GST.

Editor’s note: Don’t have a website yet? Launch your site today with GoDaddy or let the pros at GoDaddy create a gorgeous website for you.

Answers to all your GST questions

We take the stress out of deciding whether or not your business is required to charge (and submit) Goods and Service Tax. From the items that are exempt from taxation to when and where to register your business, it’s all here.

1. What is the GST?

The GST is a federal tax on goods and services. Introduced on July 1, 2000, it replaced federal and state taxes for a simplified 10% tax on products and services. The purchaser pays GST on top of their transaction.

However, GST is not charged on:

- Most basic food items

- Some education courses

- Some medical items

- Some childcare services

For more exemptions, see this handy list.

GST-registered businesses are required to submit business activity statements (BAS) on a regular basis. But don’t worry, the Australian Taxation Office (ATO) will automatically send you a BAS when it’s time for you to file.

Related: Learn how to officially register your business in Australia

2. Should my small business charge GST?

You need to register for the GST if:

- Your business has earned (or will earn) $75,000 per year or more (gross income minus GST)

- Your nonprofit earns more than $150,000 per year (gross income minus GST)

- You provide travel services via taxi, limousine or ride-sharing companies like Uber. This is compulsory, regardless of how much you earn.

- If you need to claim fuel tax credits. You can claim fuel tax credits for any taxable fuel you use in your business.

Businesses with turnover below the $75,000 threshold may still register for GST voluntarily if they choose. This allows them to claim tax credits on purchases they need for their businesses.

3. Can I register for GST online?

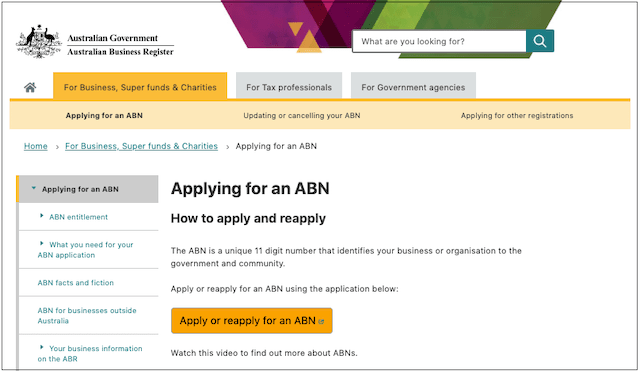

One of the easiest ways is to register for GST online by following these steps:

- Make sure you have an ABN before you register. To get an ABN, decide on your business structure (you can find help here) and then head to the Australian Government’s Business Registrar.

2. Once you have your ABN, log in to the ATO’s Business Portal. Because of changes being made to how you log in, you might need to link your ABN with your personal tax file number.

3. Once you’ve logged in, click on Business registration details.

4. Under Select one of the following options to view these details, select Registrations then click Next.

5. Select Activity Statement, then click Tax type summary.

6. You’ll likely see a message that no tax types are attached to the account, which is fine. Click Add tax type on the far right of the page.

7. Select Goods & Services Tax on the following page and click Next on the far right.

8. Then, answer the following questions according to your circumstances.

Are you required to register for GST?

Answer this based on whether your earnings meet or will meet the threshold above.

If you’re not required to register for GST, select No.

If you are not required to register for GST, are you volunteering to register for GST?

This isn’t a mandatory question, but if you’re not required to register for the GST and want to, then say Yes.

What is your date of registration for GST?

Enter a date:

- Using the format dd/mm/yyyy

- No earlier than 01/07/2000

- No more than six months from the date you are filling out the form

- No earlier than your ABN start date

What is your GST turnover?

Select from the drop-down list.

Your GST turnover amount will determine how frequently you’ll be required to fill out business activity statements.

How often will you lodge your activity statement?

- If you earn more or equal to $20 million, then your only option is to lodge a BAS monthly.

- If less than $20 million, then you can opt to lodge your BAS quarterly or monthly.

- If your GST turnover is less than $75,000 and you’ve voluntarily registered for GST, then yearly may be an option for you.

How do you intend to account for GST?

Cash is the easiest option for freelancers, sole traders and contractors. It means you account for the sale or purchase when the cash is received or paid.

If you account for the sale or purchase on invoice, then you’ll choose non-cash. If your GST turnover is more than $2 million, then you must choose non-cash unless you have ATO approval to use the cash method.

Do you import goods and services into Australia?

A simple Yes or No answer is required.

Do you wish to register for access to the Tax Office’s online services for business?

Choose Yes if you’d like to deal with the ATO via their secure channels.

If your GST turnover is $20 million or more, choose Yes because legislation requires that your BAS be lodged via digital channels.

Email address for Installment or Business Activity Statement

Add an email address for correspondence, including notifications on when your BAS is ready for completion.

9. Select Next and confirm on the confirmation screen.

You can also register by phone with the ATO on 13 28 66 or through a registered tax agent (find one here).

4. What happens if I don’t register?

Penalties and interest may apply, along with paying GST on the sales you made since the date you should have registered.

Oops, I think I should have registered. What can I do?

The ATO allows you to backdate your registration, but it’s limited to four years. Don’t put it off if you should’ve registered. Owning an honest mistake is better than running from one.

If I register for the GST and buy something solely for business use, do I pay GST on it?

This is where the BAS comes in handy. If you paid GST on the purchase for your business, then you can make a claim for a GST credit on your BAS.

If your claim for credit is greater than the GST amount you owe the ATO, you’re entitled to a refund.

What documentation do I need to claim a GST credit?

To claim a GST credit, you’ll need an invoice for purchases over $82.50. An invoice for up $1,000 will require:

- The words “tax invoice”

- The identity of the seller

- The seller’s ABN

- The invoice issue date

- A description of the items sold, quantity (if applicable) and the price paid

- The amount of GST

Invoices for amounts $1,000 and over must also include the buyer’s identity or ABN.

If you’re claiming GST credits and your invoice only shows the total with GST included, you can work out the GST by dividing the total by 11.

Register for GST only if you need to

As you can see, GST registration is simple:

- Apply for your ABN

- Log in to the government’s business portal

- Fill out the form

Make sure you keep accurate records so you can fill out your BAS and claim any credits you’re owed.

But first check if you’re required to register for GST online.

There’s enough work starting a business without having to worry about filing regular BAS reports, which is a condition of the GST.

So if you won’t be earning $75,000 for your business or $150,000 for your non-profit in the first year, think about putting it off and spending that time marketing and building your business.