If you own a business, then it's vital that you have a solid understanding of how cash flow works. A simple cash flow statement can help you understand whether your business is profitable or not, and ensure that you always have enough money on hand to cover your expenses.

The cash flow statement is essentially a snapshot of a business's financial situation at any given point in time.

Your cash flow will change every month, so you must calculate your cash flow regularly. In this article, we will help you understand what a cash flow statement is and how you can use them to manage and grow your business.

Related: Small business accounting tips to help you save money

What is a cash flow statement?

The cash flow statement is a financial report that summarizes the amount of money that is flowing in and out of your business. It is often used, along with the balance sheet and income statement, to analyze your company's financial health.

This statement gives you information about the money that flows in and out of your business and shows how the money was used. The cash flow statement is comprised of three sections that report any cash flows that occurred during that period you’ve defined:

- Cash flow from operating activities

- Cash flow from investing activities

- Cash flow from financing activities

We will take a look at each of these sections to help you understand how it all works.

Related: Everything you need to know about working capital

1. Flow from operating activities

The operating section of the cash flow statement reflects how much money your business is making and spending to produce your products and/or services. It reports the cash flow that is directly tied to your operating activities.

Operating activities may include items such as:

- Receipts from suppliers for materials used in production

- Receipts for sales of goods or services

- Interest payments for company loans

- Salaries and wages paid to employees

- Building rent and local taxes

- Other expenses related to operating your business

The cash flow from operations section can include items such as accounts receivable, depreciation, deferred taxes and amortization (loss of an intangible asset over time).

The cash flow statement will deduct the expenses on this list from your company's net income. This is because it's not money that your business is allowed to keep; you have used this money to operate your business.

2. Cash flow from investing activities

The second section of the cash flow statement reflects the sources and uses of any cash within your business that's directly related to investments. This is where an analyst may look to find any investment gains or losses that a company has experienced.

Investing activities may include items such as:

- The purchase or sale of an asset

- Loans that are made to a supplier or customer

- Any payments that are related to mergers or acquisitions

Usually, an investment is an outflow when you look at it from a cash flow perspective, because you're spending money. But companies can generate positive cash flow from this section if they sell an asset such as equipment or property.

While positive cash flows can be looked at as a good thing, many investors will look for cash flow to be generated from the operating section instead of investments and financing activities.

3. Cash flow from financing activities

The last section of the cash flow statement is about financing activities. This section helps measure the cash flow between a company and its creditors or owners.

Financing activities may include items such as:

- Payments made for dividends

- Payments used for buying back shares

- Money generated from loans

- Sales made from selling shares

- Payments made to pay off debts

When a business is showing a positive cash flow within the financing section, it means that there's more money flowing into that company than there is flowing out. When a business shows a negative number within the financing section, then this will usually indicate that the company is paying off debts, buying back shares and/or paying out dividends.

What are cash flow statements used for?

Cash flow statements can be used to:

- Show the exact amount of money gained versus the amount of money spent during a specific period

- Show your company's current liquidity and solvency, and estimate your business's ability to withstand future changes in cash flow

- Evaluate your company's assets, liabilities and equity

- Predict future cash flows by analyzing past and current cash flow trend

- Attract the interest of potential investors (if a company is financially stable)

These reports are generally considered a mandatory business report, along with the income statement and the balance sheet.

How to create a cash flow statement

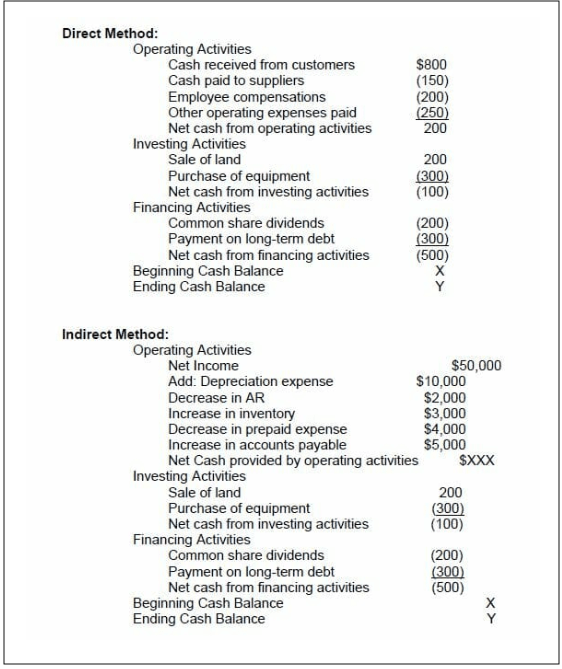

There are currently two methods that can be used to help calculate your cash flow, the direct method and the indirect method. You'll need to choose one of these methods to create your cash flow statement.

Direct method

In the direct cash flow method, you'll add up all expenses and deduct this number from the total amount of money that your business received during the period you’ve selected. This will quickly show you if your company has made or lost money during that time.

The indirect method

The indirect cash flow method is the most commonly used method because it offers a more in-depth look at the cash flows within a business.

The indirect method starts with the net income (or loss) and will add or deduct from this amount any non-cash revenues or expenses that the company has experienced. This results in actual cash flow from operating activities.

Here's an example of the direct method vs. the indirect method:

When you're creating your cash flow statements, you can use templates to help you keep track of all your company's expenditures. This helps to ensure that everything is organized and accounted for.

Here are three cash flow templates you might find quite useful:

All you need to do is download one of these templates and then start filling in the figures from your own business. This will make it easier and faster for you to make sure your business has enough money to keep itself afloat.

A key financial management tool

One of the biggest reasons that small businesses fail is because they have a lack of cash flow. This is why your business should start using a cash flow statement to help track all of your company's expenditures and make sure that you're managing your money correctly.

A cash flow statement will allow you to spot any cash changes within your business and quickly see if your business has increased or decreased its cash flow over a period of time. This insight will ultimately lead to better and more strategic decisions about the money that fuels your business.