While no two businesses are the same, the one thing they all have in common is the need for working capital.

Working capital is the money on hand to cover the cost of daily operations and expenses.

Simply put, it’s the liquid cash that can be spent on both planned and unexpected expenses. For example, payroll, vendor bills or purchases of last-minute inventory.

Working capital is also a great way for business owners to evaluate the health of their company.

Generally speaking, having enough or even more than enough working capital to cover the cost of all your short-term expenses and debts means you’re doing well. On the other hand, if you’re constantly strapped for cash, behind on paying your vendors and suppliers, or have been late paying your employees, this could mean you’re struggling.

Related: From crowdfunding to loans: how to find funding

The 5 most important things to know

Thinking about a working capital loan? Here's what you need to know.

- How do you calculate your working capital?

- How much working capital should you have?

- When is a working capital loan the best option?

- Is a working capital loan right for your business?

- How do you choose the right lender?

Now let's answer these questions so you’re armed with the information you need to make a smart decision.

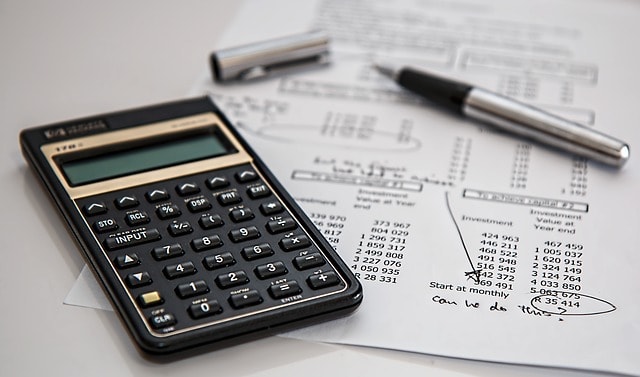

1. How do you calculate your working capital?

As a small business owner, you likely have a lot on your plate. Figuring out your working capital is probably not a top priority, but calculating it is easy. Here’s the formula:

Working capital = Current assets - Current liabilities

The main reason all business owners need to know what their working capital is because it will help you determine if your business is going to be able to cover the cost of its current or short-term obligations. A lack of working capital could cause serious financial problems for you and your business.

Let’s look at the two parts of the equation.

Current assets

All businesses should have a balance sheet, where you’ll list both your assets and your liabilities. Your business’s current assets include inventory, accounts receivable, any cash, and other assets that you plan to liquidate and make available within 12 months.

Current liabilities

Your business's current liabilities include long-term debt, taxes, employee wages and accounts payable. In other words, any obligation that is due within 12 months.

2. How much working capital should you have?

Once you’ve subtracted your liabilities from your assets, you’ll know how much working capital you have. But what is enough?

Most businesses should aim for a ratio of 2 to 1— twice as many assets as liabilities. Keep in mind, that it’s very difficult for most businesses to achieve this ratio, so just make sure you have more assets than liabilities.

Related: How to write a business plan simply

3. When is a working capital loan the best option?

While all businesses should strive to have positive working capital, this isn’t always possible.

What happens when you have more liabilities than assets, aka negative working capital?

If you have negative working capital and foresee yourself having trouble covering the cost of certain obligations, you might want to consider bringing new capital into your business. A working capital loan can be a great way to achieve this.

A working capital loan is designed to help cover the cost of your day-to-day expenses, not fund a long-term project. Because of that, these loans typically have shorter terms and are often repaid within a year.

As a result, working capital loans are not always the right answer. But there are certain situations where this type of loan can give you and your business the new capital you need, such as:

Seasonal expenses

For seasonal businesses that require extra inventory or employees during their busy season, a working capital loan can cover these costs without draining all the cash you have.

Unexpected expenses

Unexpected but important expenses occur all the time when you’re running a business. A working capital loan can not only help you cover these expenses, but also allow you to continue to cover the cost of other obligations.

A big contract

If you receive a new or larger than expected contract, you might need to increase your working capital to hire new employees or purchase additional inventory or supplies.

This is where a working capital loan is a great option.

You’ll get the money you need and be able to cover the cost of the loan once the contract is completed.

To bridge the gap

If the majority of your business comes from supplying other companies, then you’ve likely had to deal with the gap between fulfilling an order and collecting the invoice. Working capital funding can help bridge this gap so you don’t fall behind on your short-term bills.

An additional marketing push

If you’re interested in increasing your marketing reach or think now is the right time to launch your first campaign, a working capital loan could be a good choice. The business and new clients you receive from this marketing campaign should be able to cover the cost of the loan.

Editor’s note: Nothing promotes a business quite like a website. Quickly launch one with GoDaddy Website Builder. Try it for 30 days risk-free.

4. Is a working capital loan right for your business?

When you’re trying to decide whether a working capital loan is the right option for your business, it’s important to remember that this type of financing is meant for short-term obligations.

Will you be able to handle this additional cost and continue to pay your other expenses?

For those instances where a working capital loan is not the right option, you can increase your business’s working capital by:

- Cutting unnecessary daily costs.

- Paying down debt.

- Increasing your profits.

- Collecting your accounts receivables on time.

- Managing inventory more effectively.

5. How do you choose the right lender?

If you do decide that a working capital loan is the best option for your business, you need to find a lender to work with.

While there are plenty of great options available, choosing the right one is important. Here are a few things you should consider:

- Does the lender have experience in your industry?

- Will you be able to get approved for enough funds to cover your expenses?

- Do they have a history of responsible lending and a good reputation?

- Do they offer the type of customer service or support you’re looking for?

- Are there any extra or hidden fees?

Final thoughts

The backbone of all small businesses is the flow of cash, both in and out. That’s why it’s so important for you, as a business owner, to learn how to calculate your working capital, determine whether additional funds are needed, and choose the right lender based on the unique needs of your business.