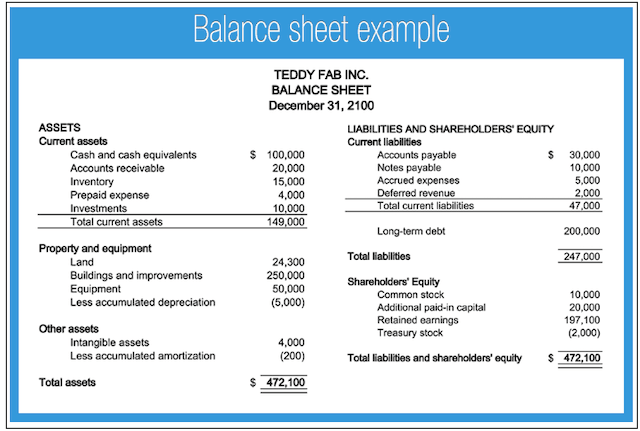

Small businesses thrive when owners know where they stand financially. Why? Financial statements let owners clearly see how well their business is performing, what they need to improve, and where they’re already succeeding. One of the tools all small business owners should use is a statement of financial position, also known as a balance sheet.

Many small business owners think they’re “too small” to benefit from some simple accounting.

But a statement of financial position allows a business to see:

- What it owns

- How much it owes

- How much equity stakeholders have at the end of an accounting period (usually 12 months)

A balance sheet is a helpful financial formula that can show small business owners how they’re doing and guide them as they make decisions for their next fiscal year. SMBs can look at their balance sheets as a guide to:

- Buying inventory for the year

- Applying for loans

- Whether they need to curtail expenses

These statements should be updated at least every 12 months.

Editor’s note: Don’t have a business website yet? Launch one today with our 30-day risk-free trial. Includes all you need to promote your product or service widely, plus step-by-step advice to guide you.

3 uses for a statement of financial position

There are three important uses a statement of financial position serves.

- Analyzing business performance.

- Attracting investors.

- Applying for loans.

Before we get into the benefits of creating this statement, let’s define a few key terms that will come in handy later.

Assets

Assets are everything that a business owns, including:

- Cash and bank accounts

- Money owed to you (accounts receivable)

- Grants

- Real estate

- Inventory

- Equipment

There is a difference between current and non-current assets as they affect the financial health of a business.

Current assets

These are assets that could be turned into cash and used to fund the ongoing operations of the business. They include inventory, accounts receivable, cash and securities.

Non-current assets

These are long-term investments that cannot be quickly turned into cash, though many non-current assets can be sold with time. These include:

- Real estate

- Equipment

- Trademarks

- Long-term investments

- Goodwill

non-current assets include both fixed (e.g. equipment) and intangible assets (e.g. goodwill).

Liabilities

When businesses can present evidence of growing assets or rising revenues and profits, it can paint a pretty picture of their operations. But businesses tend to go into debt in order to grow, and that makes liabilities a key indicator of business performance.

Liabilities are debts that a company owes, whether it’s to banks, credit companies or vendors. Liabilities include:

- Accounts payable (money your business owes)

- Mortgage and rent payments

- Customer prepayments

- Wages owed

- Debts including credit card and business loans

When it comes to separating current vs. long-term liabilities current liabilities are those that a business plans to pay within the next 12 months, while non-current liabilities are those that do not need to be paid in the next 12 months.

For example, current liabilities would include accounts payable and accrued expenses, while long-term liabilities would include mortgages or notes payable (a loan with fixed payment terms).

A mortgage is a good example of a liability that could be split between both categories. The next 12 months of mortgage payments would be considered current, whereas the rest of the loan would be long-term.

Equity/Net assets

Equity or net assets are what a business is actually worth. Owner’s equity or shareholders’ equity is a business’s assets minus its liabilities.

Net assets show how healthy a business is, including all current and long-term assets and liabilities.

A business with growing revenues or profits shown on an income statement or cash flow statement may look like it’s in a positive financial position, but only a statement of financial position takes into account all assets and liabilities to show a business’s true standing.

Practical uses for a statement of financial position

Using financial statements such as the statement of financial position make small businesses stronger. Here are some of the advantages to preparing these basic accounting documents.

1) Analyzing business performance

Small businesses that don’t keep updated accounting information can be blind to their own weak spots. Without looking at a statement of financial position, problems with growing liabilities can creep up on them and be masked by growing revenues.

Comparing balance sheets from previous years, owners can identify trends and piece together a picture of their business’s long-term trajectory.

2) Attracting investors

Smart investors don’t put their money into a company without knowing something about it first. When small businesses look for new capital to expand and grow, they need to prepare financial statements like these to show serious investors how healthy they are.

Investors look for companies that pay off their liabilities responsibly and own appropriate assets.

3) Applying for loans

Creditors want to know about the financial health of a company before approving a loan. SMBs will have a better chance of being approved for a line of credit or business loan if they can show the potential lender a reasonably healthy business.

A note about classified statements of financial position

The formula for a statement of financial position or balance sheet is remarkably simple:

Assets = Liabilities + Equity

or

Equity = Assets - Liabilities

However, this won’t necessarily provide creditors and investors with meaningful information.

They would want a classified statement of financial position, because it uses subcategories that are easier to read.

Although there is no standardized set of subcategories, most companies categorize assets and liabilities as either current or long-term (or non-current).

Using current and long-term categories allows creditors and investors to:

- Perform a financial analysis of the company

- Assess its leverage

- Evaluate its solvency by looking at current assets and liabilities

Traditional balance sheets don’t provide the same level of information. You can find a complete list of current and long-term categories here.

Use software to create a statement of financial position

Accounting software can help business owners quickly generate all of their financial statements, including a balance sheet. Software makes it quick to input all assets and liabilities and prepare statements of financial position professionally and accurately.

Preparing a statement of financial position can give small business owners peace of mind that their venture is a success and that it can continue to operate.

These statements are even more valuable when they show a business struggling, as they help the owner analyze:

- Where the problems are

- Where to look for potential solutions

- When a business can afford to grow

Complete the full picture by learning how to prepare all of your small business financial statements, including a classified statement of financial position. That way when you’re ready to apply for funding, you’ll be ready.