Whatever your niche or industry, offering your customers or clients a mix of payment options will speed your success. In addition to mobile, in-person and eCommerce payments, there is another payment option that will make your business extra attractive to today’s customers: payment links.

Payment links are swift, secure and touch-free.

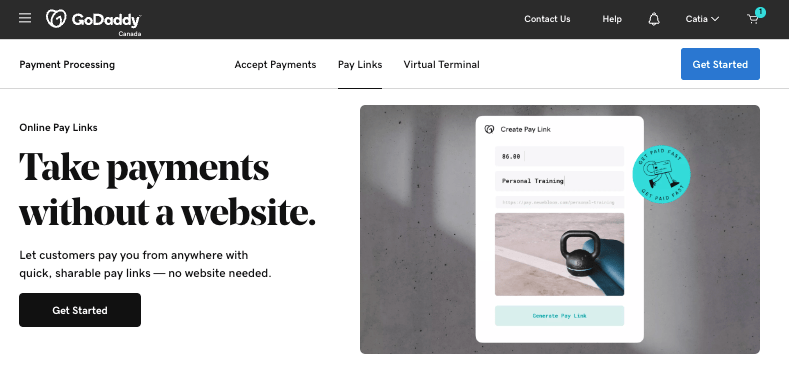

They're especially useful for any seller who doesn’t have a website.

With 43% of Canadians saying they’ve switched to digital and contactless payments for good, you’d be smart to add payment links to your options.

Here, we will explain what payment links are and how you can use them for your business.

Let’s get started.

Editor’s note: Online Pay Links with GoDaddy Payments have the lowest transaction fees in the payments industry* — just 2.7% + 0 cents CAD per online transaction.

What are payment links, exactly?

Payment links are a recent innovation, first introduced in mid-2020 when the world turned as one to contactless commerce.

Payment links allow a business owner to send a client or customer a link or QR code through:

- Social media

- Text message

Text links can also be received and used in-person. To pay, the receiver simply clicks on the link.

It’s a completely secure experience.

Related: What is a POS system?

Providers like GoDaddy use advanced encryption to hide private information during pay link transactions.

The reason that payment links are so effective is that they are fast, easy and secure. By making it as easy as possible to make a payment, you reduce the risk that buyers will change their minds — earning more sales in the process.

Of course, if customers don’t want to make a payment immediately, they can click back through and complete the transaction at a later time.

This payment flexibility will actually build trust, increasing your chances of repeat custom in the process.

The direct nature of the payment link removes potential kinks from your checkout process. A real win-win.

Different types of digital payment links

Now that you’re up to speed with the concept of payment links and you know why they’re so effective, let’s look at the different types available in today’s hyper-connected digital world.

The one-time link

This type of payment link is arguably the most popular. You can use this type of pay link across almost every customer channel or touchpoint imaginable.

The Online Pay Links feature included with GoDaddy Payments falls into this category.

With the one-time payment link, the recipient clicks through to enter their payment details (choosing from a list of payment options) in their web or mobile browser.

It’s that simple.

Here are the different touchpoints or mediums where you can send out one-time payment links:

- Text

- In person

- QR code

As you can see, there are plenty of ways to share one-time payment links. Sending these links to customers offers you a prime opportunity for extra connection or engagement.

Invoice payment link

If you own a business that offers services or subscriptions, or you sell bulk items to your customers, the invoice payment link might be for you.

With this payment option, you send a link to your customers via email;

This is the most popular medium for invoices.

Upon receipt, your customers can:

- Click through to an invoice that contains all of the relevant transaction and payment details

- Choose their payment method

- Enter the information required to make the payment

The good thing about this type of payment link is the fact that you can send timely reminders if your customers have outstanding payments.

Tip: As invoice payment links work best when sent through email, you should place your efforts in fine-tuning your email’s subject line, design and content.

“Buy now” buttons

Not many people know this, but a payment button is a type of payment link.

Because “buy now” payment buttons are standard on ecommerce sites, people have been trained to look for them.

You can place a “buy now” button on your product pages and add these buttons to your emails instead of sending a traditional payment link or QR code. These buttons take customers straight to your shopping cart.

If you have a GoDaddy website, you can quickly add a Buy Now button to any page — see how easy it is here.

Make sure your checkout process is smooth before using this tactic. This will result in less confusion, more convenience and fewer people who walk away without buying.

Best practices with payment links

As with all things, there are good, better and best ways to use pay links. Here are three rules to follow.

1. Substance over style

When developing your payment link process, it’s vital that you treat every touchpoint and type (one-off, button, invoice link) individually.

Taking this approach means that you drill down into each step of the process to ensure that your payment sequence is seamless and requires as little effort as possible.

[callout]While aesthetics are important, always prioritize function over style. [/callout]

Add a little creative branding by all means, but never if it hinders the usability of your links or payment pages.

GoDaddy Payments makes this easy — simply add your logo and business colors to your Online Pay Link and the powerful software does the rest. Your client or customer gets a fast, hassle-free payment experience.

2. Ensure your links are secure

With cybercrime on the rise, ensuring your payment pages, portals, links and buttons are fully secure is critical.

One payment data breach will cost your customers — and your business reputation — big time.

That said, it’s important to go with a provider that takes security seriously. GoDaddy Payments, for example, follows strict PCI security standards and uses advanced encryption to hide sensitive information such as contact info and banking details in its Online Pay Links.

It’s also important that you make it very clear to your customers that their data is safe in your hands by creating a clear, concise informational section in your privacy policy.

This will help you head off any unforeseen issues while building customer trust — which usually benefits sales.

3. Work with the right payment link providers

Messaging, design, and security aside, the success of your payment link offerings will largely depend on the provider you choose.

GoDaddy Payments offers secure Online Pay Links and a Virtual Terminal for remote payments.

Included free with GoDaddy’s site builders, Payments charges the lowest transaction fees in the industry.*

Before committing to a payment link provider, you should consider:

- Your budget

- Your specific needs

- Which touchpoints your customers engage with the most (e.g. web, social, text)

There are many platforms out there offering easy-to-use widgets or code, design features and payment link engagement data.

So, consider your key needs, set a workable budget, think about where you want to place or deliver your payment links and conduct comparison research.

Final thoughts

Digital payment links will give your customers flexibility in how they buy your products or services, while making the entire payment transaction swift and seamless. When you do that, great things will happen.

Explore the three main types of payment links, take the time to understand where they’re likely to perform the best, commit to a supplier that suits your needs — and start testing your efforts. The time is now.

*Lowest pricing compared to leading providers Square, Stripe and Shopify for Canadian ecommerce, in-person and keyed-in transactions.