If you run a small business or side hustle, what would you do if an unexpected emergency impacted your business? These are times when it’s essential to have an emergency business budget plan already created and ready to go.

While COVID-19 is a stark reminder of the types of emergencies that can impact a business, natural disasters, employee or customer injuries, and other problems that can show up with little or no notice.

If you run a small business, follow these tips to understand how a business budget plan for emergencies works and how you can set one up for your business.

How to create a business budget plan for emergencies

While many people neglect the business budget plan, nearly every business should have an operating budget. This budget guides your business spending and helps you meet financial and profitability targets. Without a budget, it’s hard to know if you’re making money or losing money with each passing month.

Why an emergency business budget plan matters

As a planning tool, an emergency budget gives your business operating guidelines if you find yourself in an emergency situation.

This budget should look a lot like your regular business budget plan. However, most spending categories should have lower targets during an emergency.

This plan can help you hit the ground running during a financial strain and could even wind up saving the business in some situations.

Some costs, like rent and equipment leases, are fixed overhead expenses that won’t go down unless you sell or refinance. Variable monthly costs, such as materials and labor, can be cut temporarily during a downturn.

But it’s up to you to know what cuts the business can sustain without harming the customer experience and causing undue hardship to employees.

What a business budget plan for emergencies should include

A business should keep an emergency fund, just like regular individuals and families, that it can rely on if revenues suddenly plummet. These savings are a part of your business’s working capital, so it’s important to set a target that’s high enough to sustain your business but not so high that the cash holds your business back from investing in necessary growth opportunities.

Every business’s budget looks different, as it has different needs and goals. But these high-level assumptions should be included in most business budget plans:

Labor

Staff is one of the quickest changes you can make to save money. Cutting hours or laying off workers can immediately stem losses. However, those types of cuts are extremely difficult on company morale and worker’s lives, so they shouldn’t be made without thinking of the long-term consequences.

Materials

Costs to create products or deliver a service often go down with sales. If you are in a business emergency where you project lower revenue going forward, you can make adjustments to material and supply orders to save money.

Operating costs

Operating costs like insurance, utilities, rent, lease payments, are harder to control than the variable costs reviewed above. Depending on your business, you could see modest savings on utilities, but otherwise, most fixed expenses still have to be paid during an emergency.

Realistic revenue projections

When your business experiences an emergency, it may only be cost-related. However, in the example of a natural disaster or COVID, business sales are likely to suffer as well. When working on your business budget plan, it could be a good idea to create one for a revenue-related emergency and one for a solely cost-related emergency.

Emergency funds

Your business emergency savings can be a part of your emergency financial plan. As mentioned above, it’s important to choose the right balance here. Too little savings puts your business at risk if there’s an emergency. Too many savings means you are not putting that cash into growing the business.

Financing

Business credit cards and lines of credit can act as a backstop that will keep your business running if you see a path to return to profitability. It’s best to avoid borrowing too much, as you have to pay it all back plus interest.

Related: 5 key areas to cover in a business plan’s financial projections

How to create a business budget plan for emergencies

When creating a business budget plan for emergencies, you should start with a look at your current income statement, balance sheet, and operating budget. Using that, you can break down your budget for different emergency scenarios. This is how you will create your business budget examples to follow in an emergency.

How to break down your budget

Preparing your business emergency budget is a lot like creating a personal budget. Create a category for each spending area and target spending limit for that category. You can choose very detailed categories or more broad categories. Choose whatever will work best for your management style and business.

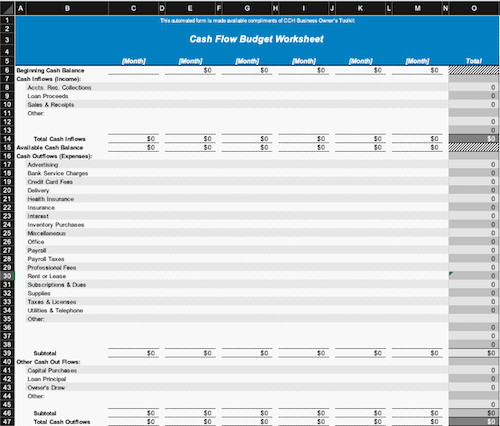

- Detailed line-item budget: If you keep detailed bookkeeping and accounting records already, it’s easy to turn your income statement into a budget. Turn each line-item from your books into a budget line to create a detailed emergency budget plan.

- 50/30/20 budget: More popular with personal finance, businesses can also follow this model where 50% is spent on needs (fixed costs), 30% on wants (variable costs), and 20% of income is put away for savings and investments.

Recommended tools for creating a budget

Now you know the basics of how your business budget plan should work, you can use any of these tools to create your actual business budget example for emergencies:

- Microsoft Excel: Microsoft Excel is an extremely popular spreadsheet tool that you may already use to run a part of your business. Powerful Excel functions make it easy to create your budget in Office 365 online or your desktop.

- QuickBooks: QuickBooks is a recognized name in small-business accounting. Using either cloud-based or desktop-based versions of QuickBooks, you can handle virtually all of your business accounting and bookkeeping needs including budgeting.

- Xero: Xero is a cloud-based bookkeeping and accounting system that works with a large number of add-on apps. Xero includes features to build a business budget plan in the app or using one of the various budgeting tools in its marketplace.

- Divvy: Divvy is a corporate card and expense management platform that includes useful budgeting dashboards. If you have a team of workers with their own spending cards, Divvy can help you better control and estimate their spending each month to stay in line with your business budget.

Tips for success

For your business budget plan to work, it’s important to have both a realistic budget, one that you’ll really use. Don’t be one of the well-intentioned business owners who go through the steps to create a viable emergency budget but don’t put it into effect when an emergency strikes.

Also, keep in mind that you may have access to emergency loans or assistance depending on the type of emergency.

Contact your insurance company and your local government office to learn more about the resources you could have available. In the event of a national disaster like a hurricane, earthquake, or viral outbreak, you could have access to FEMA funds or a program like the Small Business Administration Paycheck Protection Program to keep your business afloat.

Related: How to help ensure Paycheck Protection Program loan forgiveness

Business emergency budgeting next steps

According to a poll from the U.S Chamber of Commerce, 82% of small businesses are concerned about the pandemic. But of that 82%, only a fraction have likely taken the steps to shore up their finances and prepare to last through an emergency.

If you have not already, get your business budget plan together for both regular times and emergencies. In the long-run, it’s the right decision for your business. And if an emergency ever does arise, you’ll be glad you have a plan in hand and ready to go.