When you start an LLC, it’s an exciting time for a business owner, but it can also be daunting. There’s a lot to think about, from paperwork and certification to registration and more.

In this six-step guide, we’re making the process as simple as possible. We’ll take you through the LLC journey from picking a name to registration and forming your LLC. It’s important to note that how you start an LLC will depend on the state you’re in, so check local legislation as you go.

Disclaimer: This content should not be construed as legal or financial advice. Always consult an attorney or financial advisor regarding your specific legal or financial situation.

What is an LLC?

An LLC, or Limited Liability Company, is a business structure that creates a boundary between your personal assets and your business. Think of it as a protective shield that separates what you own personally from your business’s finances.

When you start LLC formation, you’re setting up a legal divide between your personal belongings and your business.

LLCs are popular for their mix of structure and flexibility. You can choose to run an LLC on your own as a “single-member LLC” or with others as a “multi-member LLC.” There’s also no need for formal board or officer titles, which gives you more control over the organization and management of the business.

If you’re considering setting up limited liability company status, the process includes a few key steps: choosing a unique business name, filing your Articles of Organization, and selecting a registered agent. Starting an LLC can be an empowering way to lay a strong foundation for your business while keeping your personal and business matters separate.

What are the benefits of an LLC?

There are benefits to starting an LLC, and below we’ve listed some of the most desirable reasons why you might want to switch to an LLC business model.

- Limited liability protection removes liability from you personally. Your business becomes its own entity, responsible for its own debts or legal obligations.

- Pass-through taxation allows owners to take earnings without paying tax first. The profits and losses pass through to the owners' personal tax returns.

- Easy to form and maintain (especially now that you’ve read this article). LLCs can be set up in as little as six steps.

- Business credibility is developed from having a registered LLC business. It could even help secure higher ticket clients or help justify price increases.

- Transfer of ownership is easy and flexible for LLCs.

What is the downside of an LLC?

Managing an LLC requires some further work that could be perceived as a downside. For example, you will need to manage paperwork and filing differently. If you used to manage taxes alone, you might start considering an accountant to help manage your finances as you start an LLC.

What type of LLC should you set up?

Thinking about taking that next big step toward becoming an LLC? The first choice you'll face is deciding on the type that suits your business best. There are several types of LLCs available, each with their own advantages and disadvantages, for more on this you can check out our list of different types of LLCs.

If you’re curious about how to open up an LLC that matches your goals, here’s a quick breakdown of the main types:

- Single-Member LLC: Ideal for solo entrepreneurs, this LLC type lets you be the sole decision-maker. You get personal liability protection and a straightforward setup without the need to coordinate with anyone else. Think of it as the “go-it-alone” option with big benefits.

- Multi-Member LLC: If you have business partners, this type is the way to go. A multi-member LLC allows you to share the workload, profits, and responsibilities. With an Operating Agreement, you and your partners can clearly define roles and set up fair profit-sharing.

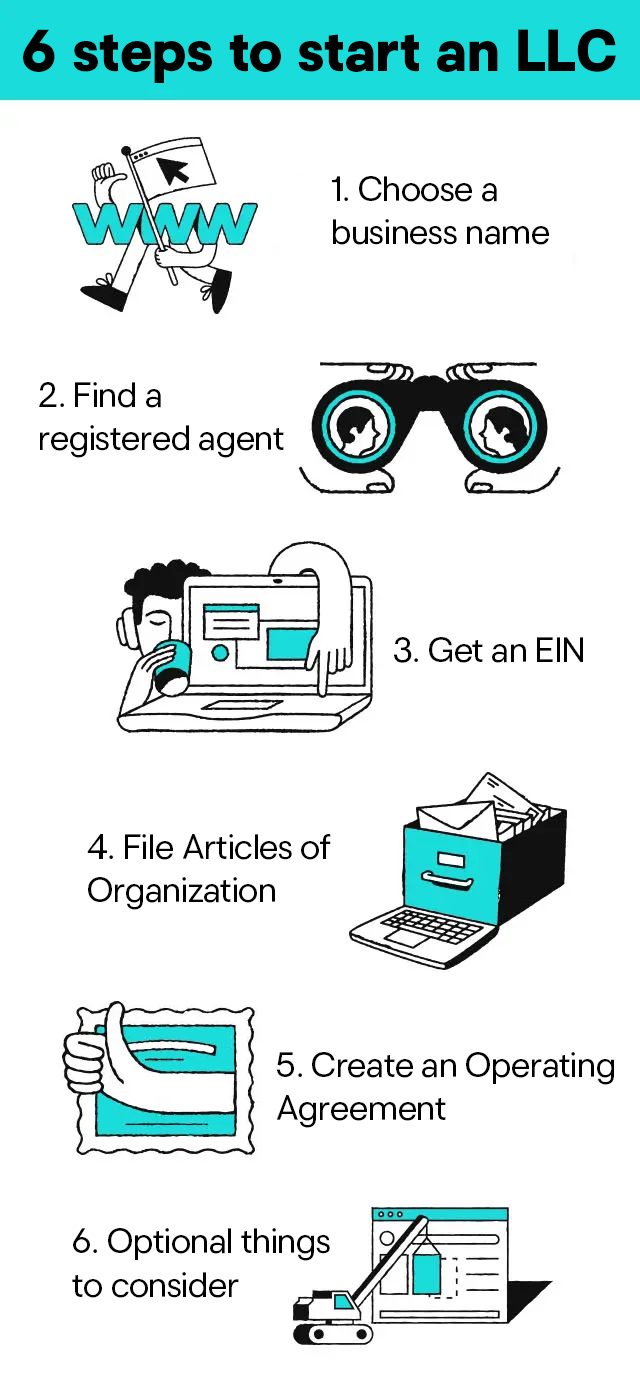

6 steps to start a LLC

1. Choose a business name

Every business needs a name but it’s easy as an entrepreneur to overlook this point. Before registering your business to become an LLC, make sure the matching domain name is available. The last thing you want is to choose a name to find it’s already in use or trademarked.

Enter your desired domain into the search bar and hit Buy It. If the domain is available, it’ll be there for sale; if it isn’t, GoDaddy will provide options that might inspire you.

An available domain indicates that the business name is available but do your due diligence and check via registration offices.

There may also be state restrictions on words you can use within your business name. Restricted words might include ‘bank,’ ‘trust’, ‘trustee’,’ or ‘corporation.’ Basically, your business name must reflect your business and not be misleading.

Once you’ve confirmed your business name is available for use, you can buy a domain, choose a web hosting plan and create your website for your own online business.

For more information on the importance of domains, check out the video below.

2. Find a registered agent

Appointing a registered agent is a must-do in the process of starting an LLC in most states. Your registered agent will generally need to have a physical address in the state in which your LLC is registering.

The role of the LLC registered agent is to pass important documentation to key personnel within the LLC. Your registered agent will forward documentation such as legal notices and tax forms. Your registered agent should notify you of any legal issues at your earliest convenience. It’s an important role, and if someone within the company is going to take it, they need to be diligent.

In many cases, the option for a registered agent service is highly desirable. This way, you can hire someone (or a company) to handle the legal and administrative tasks of being a registered agent. Hiring someone is especially useful if there’s no one qualified or happy to take on that role within the LLC. Or, if there’s no physical address within the state the company is registering in. You can learn more about registered agents, including how to be one yourself, or how to hire one, in our what is a registered agent guide.

3. Get an EIN (Employer Identification Number)

Your EIN (Employer Identification Number) is a federal identification number issued by the IRS and acts as your LLC’s unique identifier for taxes. It is essential for many types of activities, including opening a business bank account, hiring employees, filing taxes, applying for licenses and permits, and more.

Essentially, your EIN proves you’re an established business.

Even if you’re not planning to hire employees immediately, having an EIN makes it easier to manage your business finances separately from personal ones and gives your LLC a professional edge. You can apply online directly through the IRS website for free, and it’s typically a quick process.

Setting up your EIN brings you one step closer to a fully functioning, legitimate business.

4. File the Articles of Organization (Certificate of Formation)

Your Articles of Organization (aka. Certification of Formation) is a form that you can pick up from your local government agency, like a Secretary of State.

You will need to file the form and provide the information required. Each state has its own form so it’s important to make sure you’ve picked up the correct one. You can expect to fill out your typical information, such as the company name, business address, names and addresses of the LLC owners.

How much does it cost to apply for an LLC?

When submitting the form, you may need to pay a filing fee. In states such as Arizona, Colorado, Michigan, and New Mexico, LLC filing fees are as low as $50, while Massachusetts has the highest filing fee of $500.

5. Create an Operating Agreement for your LLC

Your Operating Agreement is a bit like a contract between owners. The document is legally binding and outlines how the LLC will be managed. Even if it’s not required by law, having one is incredibly helpful, especially as your business grows

Importantly, the Operating Agreement is in place to outline how profit and losses are shared and could be used to resolve potential future conflicts. When creating this agreement, it can be helpful to work with a lawyer.

Here’s a look at the key questions your Operating Agreement should answer:

- Who owns what? Clearly list each member and what percentage of the LLC they own. This keeps ownership clear and straightforward.

- Who does what? Outline roles and responsibilities for each member. This could include managing finances, handling daily operations, or leading certain projects.

- How are decisions made? Decide on the process for making big decisions. Will everyone get an equal vote, or will certain choices require a majority?

- How are profits and losses split? Describe how you’ll divide profits (and any losses). Will it be based on ownership shares or something else?

- What happens if someone leaves or joins? Set guidelines for what to do if a member wants to leave or a new person wants to join. This keeps things simple and prevents future issues.

- How will we dissolve the LLC if needed? Outline the steps for closing the LLC if you ever need to. This helps everyone know what to expect if it comes to that.

The agreement means that all owners are aligned on some of the most important aspects of starting an LLC.

6. Additional things to consider when creating an LLC

Finally, take a moment to think about any other items that are state-specific or necessary to start your LLC with the best possible foundations.

Some extra considerations might include:

- Setting up a business bank account. Although a separate account to manage business finances is best practice for any business, when you start an LLC, you want to be especially diligent in keeping your personal finances from your business finances. This will make tax returns infinitely less confusing, and you must remember, with an LLC, you have a business that is a separate entity from you, so it will have its own bank account.

- Obtain permits and licenses. You might need specific licensing and permits depending on your industry and location. Be sure to check that all your paperwork is neatly gathered and legally compliant.

- Registering to do business in other states. If you’re registered in one state but have assets or employees in other states, you may need to register to do business elsewhere. This is dependent on the states you’re working within. If you need to register in other states, you’ll need a registered agent there, too.

Find your state in the table below to get started with the business application process.

Related: How to register a business

Your questions about starting an LLC, answered:

It’s common to have a lot of questions before deciding whether or not to make the leap into an LLC business. Here, we’re answering commonly asked questions.

Additionally, learning how to write a business plan can help you formalize a strategy that'll keep your ideas on track. You can also check our free business plan template.

What is the lifespan of an LLC?

The lifespan of an LLC varies, but some states require it to be 30 years or indefinite and can continue until the owners dissolve it.

How do you make money with an LLC?

You can make money as part of an LLC as you would in any business. Your LLC might make money buying and selling products through selling services or offering memberships and subscriptions to customers.

The main difference is how you make money with an LLC. As the owner, you might also be contracted to work. So your LLC pays you a wage.

Should I pay myself a salary from my LLC?

You should seek financial support before deciding how to pay yourself through your LLC, but as above, there’s an option to pay for contracted hours for services benefitting the business. Or, as the owner, you can take distributions.

Can I use my personal money for my LLC?

As a business owner, you can use personal money to fund an LLC. This is particularly common in the early days of starting an LLC.

Can I transfer money from my LLC to my personal account?

Transferring money from your LLC to a personal account is also legal, but it’s important to document it correctly. If you are actively working on day-to-day operations, you should be classified an employee and pay yourself a reasonable salary, just like any other employee.

As an LLC owner, you may also take distributions of the LLC’s profits. These are not subject to payroll taxes. Just remember to record each distribution to avoid any tax complications.

Do LLC owners get W-2?

Typically, the answer is no. If you’re setting up limited liability company and only receiving distributions of the LLC’s profits, you will need to file a 1099-NEC. If you decide to pay yourself a salary as an employee, then you would get a W-2 just like any other employee on payroll.

Choosing between a W-2 and a 1099-NEC affects your taxes. With a W-2, taxes are automatically withheld, so you’re set for tax season. But if you’re getting a 1099-NEC, no taxes are taken out upfront. You’ll need to set aside money for self-employment taxes (e.g. Social Security and Medicare) on your own. Without careful planning, this can lead to a surprise tax bill or even penalties.

Final thoughts on starting an LLC

Owning and managing an LLC doesn’t stop with the six steps feature above. Once you know how to start an LLC, you must look after it and keep your new-found LLC in line with the state’s ongoing requirements. You’ll need to file reports and accounts accordingly. And on top of that, you must keep an eye out for potential changes in legislation.

Whilst it can feel overwhelming, there are attorneys and accountants to help you take the right steps when starting an LLC. And, when the time comes to managing new legislation, you’ll feel ready to tackle it when the time is right.