Small business owners are often so busy with the day-to-day duties of running the shop that they de-prioritize keeping their financial statements organized. After all, it’s not the most glamorous part of owning a business. But taking steps to keep your business finances in order will ultimately save you time and money.

Especially at tax time.

Why not just throw all your paperwork at your accountant and have them wade through it to complete your tax return?

The more disorganized your information is, the bigger the tax bill (not to mention, your accountant’s) will be.

And if you don’t have an accountant, it’s time to start looking. Check out these tips for finding an accountant so you can start off the year on the right foot. Tax accountants aside, there are some things you can do to not only minimize your tax bill, but also save you some time that you can use to grow your business.

Disclaimer: This content should not be construed as legal or tax advice. Always consult an attorney or tax professional regarding your specific legal or tax situation.

1. Buy good accounting software.

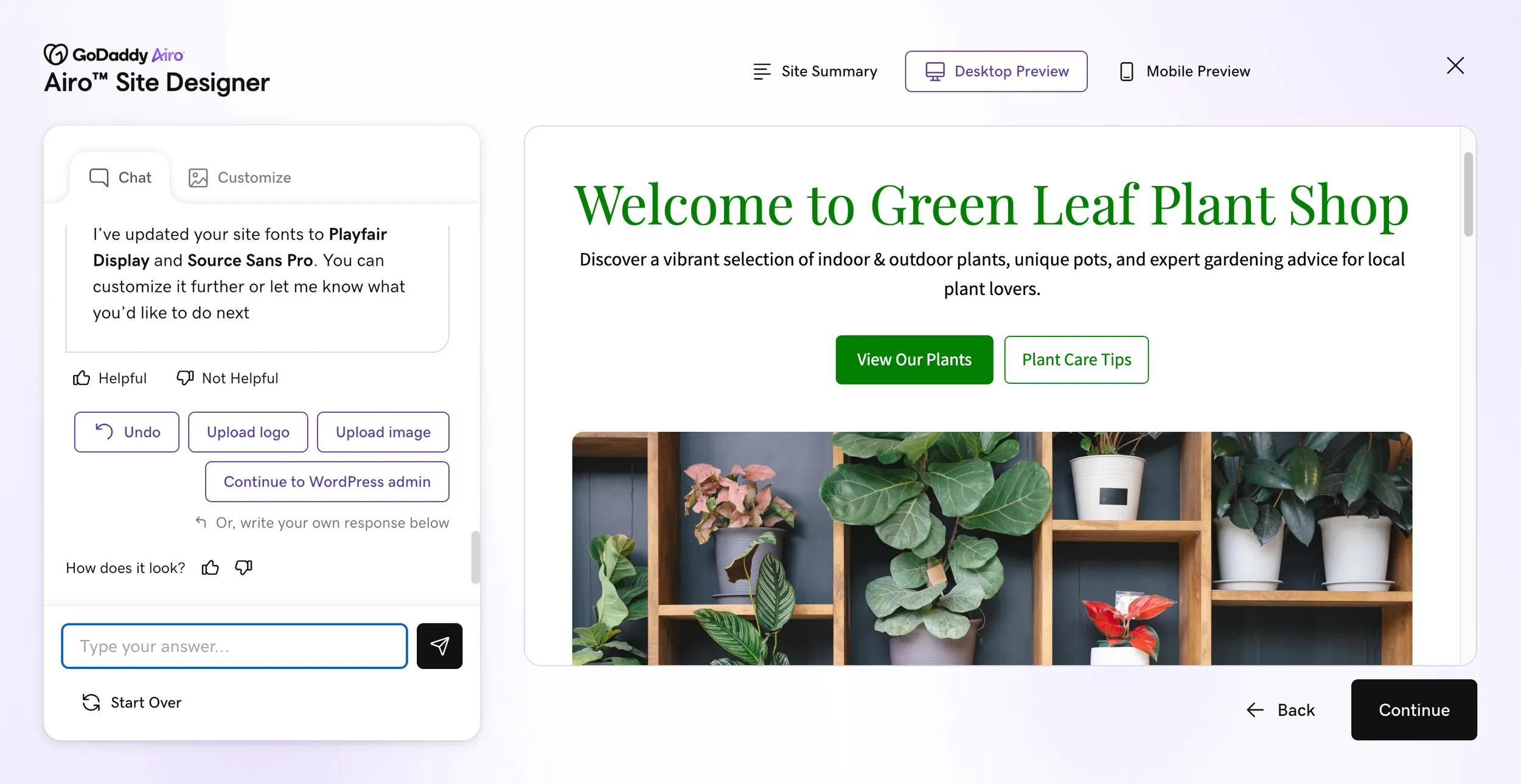

Accounting software has advanced to the point where the average person can enter all of their transactions into the software without an accounting degree. With software such as GoDaddy’s Online Bookkeeping, you can do things like download transactions from your bank or online payment system, and input expenses and revenue.

In addition, an accounting program can give you a look at how you are doing financially, tell you whether you are meeting your goals, and tell you what you can do to improve your situation. In addition, if your accountant provided some tax savings tips, you can keep an eye on the expenses that will give you those tax savings.

2. Spend time on your financial statements each month.

You have gone from being an employee to an owner. Every number on those financial statements belongs to you. You should be keeping an eye on the money going in and out of your business bank account as well as your personal income.

By going over your financial statements on a monthly basis, you will be able to catch items that are in the wrong accounts, which could have an effect on your deductions.

In addition, you can ask your accountant questions during the year so you can make sure you are recording your transactions correctly, or resolve any issues before they happen. Lastly, you may end up saving money at tax time since you won’t be hurried to get things to your accountant.

3. Attach copies of the receipts.

One of the great advances that have come with software like GoDaddy Online Accounting is that you can attach copies of receipts to your transactions.

You can either take a picture of the receipt, or save an electronic copy to the transaction to which it belongs.

This can help your accountant since he can see exactly what you bought, and be able to tell you how you can deduct it.

4. Set up accounts to match what is on the tax forms.

If your account name matches the name of the line on the tax form to which it relates, your accountant will know exactly where to put it on the tax form. Easy enough.

5. Break out items that can be used for more than one year into a separate account.

You might buy things like computers and printers, as well as other equipment, that can be used for more than one year.

Record these items in a separate account called Fixed Assets.

This will help your accountant know what to record as depreciation expense for this year and going forward.

6. Track your mileage and keep it up to date.

Many accounting programs have a place for tracking the miles you drive for business. By using this feature, you can get an accurate mileage number to your accountant to use to determine your mileage deduction. Learn more about writing off auto expenses.

7. Have a separate account or method for tracking inventory.

On the Schedule C, used for reporting income for small businesses that have not incorporated, there is a section that will show your cost of goods sold.

To help with year-end taxes, have accounts set up to show your inventory balances.

At tax time, provide this account’s balances at the beginning and end of the year, as well as the activity during the year, to your accountant so they can calculate your cost of goods sold.

8. Have a separate account for items you donate to charity.

While you cannot deduct contributions to charity on a Schedule C, you can deduct them on your itemized personal return. Setting up an account to keep track of these items will help your accountant get you the deduction to which you are entitled.

9. At the beginning of the year, ask your accountant the format in which they want to get financial information.

Most accountants strive to act as business partners with their clients. Talk to your CPA about how you can make things easier for them at tax time. Not only will you simplify your taxes, but you will also gain a teammate who can guide your business through the financial challenges you may come across.