No matter what business you’re in, unexpected business costs always seem to crop up. Sometimes even seemingly inexpensive surprises can throw a monkey wrench into the works, because finding the cash to repair a plumbing problem, replace broken equipment, or tackle some other emergency can be challenging if you’re not prepared for it.

Not all businesses or surprises are the same, but here are some of the most common unexpected business costs you might face:

1. Equipment breakdowns

Depending upon your business, this could be construction equipment, a machine tool, a pizza oven, or even a computer.

If you have equipment that is critical to your ability to do business, you need to make sure you either have a rainy day fund or access to quick capital to fix or replace it to keep the doors open.

For example, an Italian restaurant can’t get by without their pizza oven for long before it starts to negatively impact business.

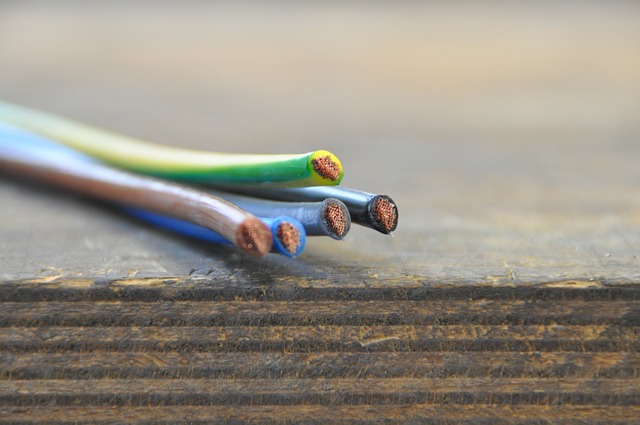

2. Problems with utilities

If you operate out of an older building, it’s not uncommon to occasionally face plumbing or electrical problems. The cost of digging up a sewer line to the street or hiring an electrician to rewire an old building could be an extra few thousand dollars of expense that you hadn’t planned for.

3. The business costs of growth

As your business grows and the need to hire more employees becomes critical, there can be unanticipated business costs like the need to purchase additional supplies or training, or even a new desk and office equipment. Depending upon your business, ramping up a new employee can cost as much as several thousand dollars. Most business owners want to see their business grow, but growth can be expensive in the short term.

4. Unexpected opportunities

Not all surprise expenses are the result of a problem.

Sometimes opportunities arise that require extra capital you might not have planned for.

It could be an opportunity to purchase quick-turnaround inventory at a steep discount, or that piece of time- and money-saving equipment you’d been looking for suddenly becomes available. Maybe the tenant in the property next door is leaving and you have the option to expand your retail space or add seating in your restaurant. The opportunity to expand might make it possible to serve more customers and generate more revenue in the long run, but will include some expenses you might not have foreseen.

These are just a few of the unexpected business costs that can take small businesses by surprise. Of course, there are others, like the need to ramp up for a new contract, costs associated with launching a new marketing campaign, or expenses required to introduce a new product.

Planning for unexpected business costs

A rainy day fund is a good place to start. However, determining how much you should set aside to cover unexpected business costs can be a challenge.

Many business owners choose to set aside a fixed amount every month hoping it will be enough, but taking a more strategic approach to anticipate where extra capital will be needed can help make it less surprising.

As you start planning for the next year, it’s a good time to ask yourself a few questions and take steps to prepare:

1. How old (or reliable) is the equipment I need to conduct business?

There’s nothing wrong with older equipment (provided it gets the job done), but if it’s critical to doing business, it might be a good idea to have it checked by a professional to determine whether or not there are any maintenance or repair issues looming that you might not be aware of. That way, you can be prepared with the cash you will likely need — or develop an alternative strategy to pay for the repairs.

2. Do my suppliers regularly offer discounts I can plan for?

Like many businesses, some of your suppliers may have ebbs and flows in the amount of business they do over the course of a year. Are there standard times when they typically offer extra discounts to boost their revenues? If so, you can plan ahead and be prepared to take advantage of those times with adequate cash available for just such an opportunity.

3. Do I plan to hire a new employee or two next year?

Onboarding new employees doesn’t have to be expensive, but there are costs associated with a new hire — particularly if the hire is part of an expansion or growth initiative. Phones, desks and other office furniture or supplies could be an expense to consider. Onboarding a new employee could also include a uniform, a new computer, or even additional insurance for a new delivery driver. Depending upon the nature of your business, and the nature of your employees, you may also be required to supply the tools they’ll use while in your employment.

Fortunately, hiring new employees is usually something a business owner can anticipate. Planning ahead and considering what the additional costs of a new employee might be in your business will help you be prepared for any new employee’s first day.

4. Is my business going to need extra attention this year?

Fortunately, many plumbers, electricians and others will inspect your plumbing, electrical or HVAC and evaluate the potential for a problem — and can likely provide an estimate for possible repairs. You may even be able to catch and resolve an issue before it becomes more expensive.

In addition to saving for a rainy day, there are short-term financing options that allow a business owner to access capital quickly to meet an unexpected expense.

Online business lenders can often approve a loan application in under an hour and have cash in your business bank account within a day or two — sometimes as quickly as 24 hours. Nevertheless, strategically looking ahead at potential business costs is still a good idea.

There’s an old adage that most small business owners can appreciate: Plan for the best, but prepare for the worst.