Many entrepreneurs decide to do business under a different name. The name they choose to do business with is not the same as their personal name. It is a made-up name that allows entrepreneurs to conduct very real business, such as collecting checks and payments.

What is a DBA (doing business as)?

A DBA, or "Doing Business As", refers to the name under which a business operates and conducts trade, even if its legal registered name is different. It is essentially an alias that a business uses for marketing, branding, or other operational purposes while keeping its formal legal name for legal/registration purposes.

Generally, in the United States, businesspeople are required to use either their personal name or a publicly registered business name. A DBA is one way to use a legally registered name while doing business.

A DBA does not:

- Function as a business structure (e.g., corporation)

- Protect you, your assets, or your business from liability

- Provide exclusive business use of a name (trademark)

- Apply broadly; it only applies in the county or state where you registered

- Hide your identity

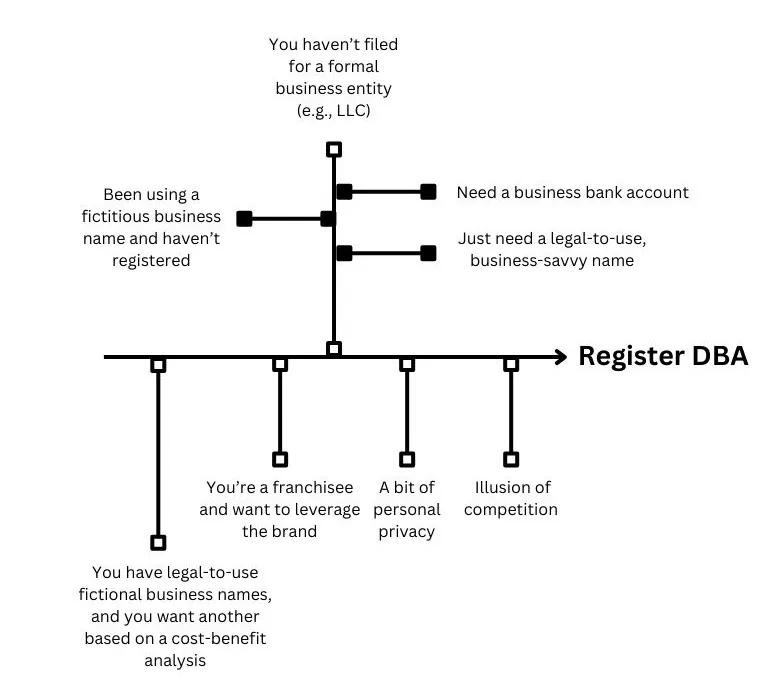

Do I need a DBA?

Whether you need a DBA depends in part on whether your business structure is a sole proprietorship or partnership, or one of the entities that require formal registration with the government.

Other factors matter. The decision to create a DBA is a business decision with a cost-benefit analysis that changes based on context.

Let’s walk through the analysis.

Sole proprietorships and partnerships

For sole proprietors and partnerships, filing for a DBA is highly recommended. As a sole proprietor, your legal business name is just your personal name—for example, "John Smith." Partnerships are typically named after the business owners, such as "John Smith and Jane Doe Consulting."

To create a branding-friendly business name, sole proprietors and partnerships should file for a fictitious business name or DBA—for example, "Smith Consulting" or "Smith & Doe Associates." This projects a more professional brand image for marketing purposes while keeping your personal legal name intact.

LLCs and corporations

LLCs and corporations are legally required to register an official legal business name, so a DBA isn't always needed. However, they can file for a DBA as an alternative operating name. For example, an LLC named "ABC, LLC" could file a DBA as "ABC Consulting" or other name variations.

The benefit of a DBA for LLCs/corporations is that it provides flexibility if you want to use a different name than your formal legal name for branding purposes. For example, a corporation could use DBAs for different product lines or regional locations.

Franchises

Franchises are typically required by the franchisor to legally operate under the franchisor's brand name. For example, a McDonald's franchise must use the McDonald's name and branding. Registering a DBA separate from the franchisor's trademarks would generally not be allowed or advisable in most franchise arrangements.

However, franchises could potentially file a DBA for any separate business activities, such as side ventures, provided they do not compete with the franchise. To avoid conflicts, any DBA use should only be done with the franchisor's explicit approval.

Disclaimer: All known trademarks contained herein are the property of their respective owners and their inclusion does not represent any affiliation, endorsement, or sponsorship.

DBA benefits

Why might you want a DBA?

Not every single business needs a DBA.

- Some businesses, because of their specific situation that might benefit from a DBA, could instead get better results for the comparative cost with a formal business entity.

- At the same time, as a business evolves, it may create new DBAs and shed older ones.

Follow the law

- If the business name you’re using isn’t just your personal name, you need to register it somehow.

- If it’s already registered because it’s the name of your corporation or LLC, and you’re in the same jurisdiction where it was registered, then you’re good to go.

A trademarked name is the exclusive right to use a name across the nation, but trademarking a name doesn’t necessarily mean you have the right to use that name in a jurisdiction where you haven’t registered it.

Legal issues for businesses, especially startups, can be numerous and difficult to handle.

Marketing and professionalism

Your personal name only goes so far in business. Potential clients and vendors need to know critical information. What do you sell and to who? If this information isn’t conveyed clearly and quickly, you may not be seen as a professional.

Ana would like to open her dental practice in a small town, but nothing about her personal name says dentistry. She calls her office “Bright Smiles.”

If you’re operating in multiple geographic areas, selling multiple products or services, or running multiple websites, you may need multiple business names.

Opening a business bank account

Most banks require a certified copy of your DBA when creating a business bank account.

Without a DBA, you would not be able to issue or receive checks under the assumed name of the business.

The business owner cannot use their personal account for transactions pertaining to the business either.

Privacy

Anyone can look up a DBA and the person who registered it in public records. But to find your personal name, if you do register a DBA, someone would have to take that additional step of research.

There isn’t complete privacy with a DBA in other words, and there shouldn’t be. These records are there for the benefit of the public so people have recourse. But there is an additional step that weirdos have to take to figure out your full legal name.

Jurisdictions across the board require contact information like an address on the record so you have to pick the right one, not your home, preferably.

Create the illusion of more competition

Trademarks create a barrier to competition to some degree. They wall off your brand and the niche you occupy. Likewise a DBA can hamper competitors if only by signaling more competition than they’d like to face.

It’s not unheard of for companies, perhaps unscrupulously, to generate many DBAs that appear in Google searches and on physical signs, but with fundamentally the same business assets involved in operations. I.e., one company with many faces to scare off entrants and competitors in other areas looking to expand.

Ease and cost of registration

There’s no authority on the cost of DBA registration so let's do the averages ourselves. Usually when you pay a jurisdiction and file things correctly you get a certificate, often called an Assumed Name Certificate.

States and counties tend to charge you for DBA registration. New York State charges $25, for all business structures including corporations and LLCs. For whichever counties where the corporation would operate, most charge $25 and some set the bar at $100.

- The State of Texas charges $25. Its counties also charge separately, usually around the same amount as the state.

- Florida charges $50. Its counties don’t charge, but Florida makes you file “notice” in local “newspapers” (publications). The Jacksonville Daily Record charges $32.50. The Orlando Sentinel charges $25.

- The State of California doesn’t process or charge for DBAs, but its counties do. California’s Alameda County, for example, charges $40.

You can also pay a bit more money to a third-party service. They’ll do the form & filing legwork. It won’t be hard to find one.

DBA vs LLC vs Trademark

Many small business owners get confused about the differences between Doing Business As (DBA), Limited Liability Companies (LLCs), and trademarks. Here’s a quick rundown for understanding the unique purposes of each:

DBA

A DBA is simply an operating name for your business that is different from its legal name. Sole proprietors commonly use DBAs so they can name their business something other than their personal legal name. LLCs and corporations also use DBAs to take on a business name different than their formal legal name. The key thing to know is that a DBA does not create a separate legal entity — it is essentially an alias.

LLC

An LLC (Limited Liability Company) is a legal business structure that actually provides liability protection and other benefits for the owners. When you start an LLC, you are creating a new, separate legal entity with its own name. This offers more formality and operational flexibility than just filing for a DBA. However, an LLC can still use a DBA if they want to market themselves with a different operating name.

Trademark

A trademark protects unique names, slogans, logos, and brand elements that identify a business or product. It legally prevents others from using or copying your distinctive brand identity. A business can trademark its name, logo, taglines, etc. whether it operates as a DBA, LLC, corporation or other business type.

Unsure about how trademarks work? Learn more about trademarks with our handy guide.

The takeaway is that a DBA simply provides an operating name, while an LLC establishes a formal business structure and legal entity. Trademarks protect established brand identity elements. Using these three in combination can help build and protect your brand.

How to file for a DBA

Generally speaking:

- Identify your state and counties

- Brainstorm names

- Analyze the comparative value of potential names

- See if a favorite is available

- Pay and file

- Mark “calendar” and stay on top of updating requirements

Which states and counties should you look at? Here’s a test: Wherever you physically work, and if you’re remote, also wherever your work is sent and worked on by someone else.

How to choose a DBA name

You should choose the DBA name you’d like to use in business. Ask yourself: How do I land an expectation of value in the minds of potential clients?

- Specific and concrete benefits

- The actual service or product

- The geographic location, or source of product where applicable (e.g., local)

- Vision and objectives (e.g., environmentalism)

Application information

Your DBA form will require specific pieces of information. These include the name of the applicant, the date of the filing, the DBA name for the business, and the address of the business. The DBA must also be filed in the state or county of the business’s principal address location.

Application fees

Generally, these tend to be inexpensive but will vary by the state or county that you’re doing business in. The range for fees can be anywhere from $10 to $150, so be sure to check your local laws around DBAs to find the fee that would apply to your business.

Some entrepreneurs file for DBAs on their own. Others choose to work with business filing experts at a third party online legal filing service. These individuals help file the DBA application on the entrepreneur’s behalf, and check the status on when the DBA is fully registered. Working with a third party helps save time, and allows entrepreneurs to ask filing experts any questions they may have about the process.

If you are unsure of whether it is best for you to work with a third party or file for a DBA on your own, consider consulting a legal professional for advice. Every entrepreneur’s situation is different when it comes to their business, and it is for the best that you do not attempt to DIY the process if you don’t understand it.

What happens after my DBA registration?

After applying for a DBA, certain states may require you to publish information about the DBA. Why must this be done?

Publishing this information puts a notice of the filing on record and provides proof of your identity.

This information may be published in at least one local newspaper to give proper notice to other local business owners. Typically, it is required to be published within four weeks upon receiving the DBA notice.

After publishing, you are officially on public record. This better allows consumers to discover who the owner is behind the (fictitious) name of the business.

However, it is still advised that you get in touch with the Secretary of State. This allows you to better understand what the requirements are for publishing information about the DBA, and find out if there’s anything else you need to do post-DBA registration.

Now that you have your DBA, place the document in a safe place and enjoy the peace of mind that comes with doing business under a different name.

What if my state does not require a DBA?

Do entrepreneurs need to file for a DBA, even if it’s not a state requirement?

The answer is yes.

It is best advised to file for a DBA (and conduct its name search) sooner than later for the business. Even a budding side hustle on its way to taking off can utilize the protection of a doing business as name.

DBAs are not required in every state. Some states do not require doing business as name registration. However, it’s still smart to register for the business name on a voluntary basis.

The right business name is a great starting point for building a network as a business owner. Pick the right one and register it. You may need additional trading names, and that’s fine; just be thoughtful and keep your legal stuff together. Trademarks and entity formation are tools with conditional value, so keep them in mind with DBAs in the same toolkit.

Doing business as FAQ

What does DBA stand for?

DBA, or d/b/a, stands for “doing business as”. It is also called an assumed name and a trade name. In other countries they might write t/a or “trading as”.

What is an example of a DBA?

The youths of Talented Dancing Team in sunny California beach town set up shop on a few boardwalks. They approach local business owners to set up events. They’re paid a base fee and take tips from appreciative customers. The name they use is registered with County.

Why would someone do a DBA?

Satisfy a typical legal requirement in local and state jurisdictions: Register fictitious business names with the government so the public knows the actual people running businesses. Business decisions affect the real world: Clients, vendors, employees, and members of the public affected by externalities (e.g., pollution).

Is a DBA or an LLC better?

LLCs are business entities with specific attributes while DBAs are registered business names. They are not substitutes. In fact, they are often complementary tools.